Share Post:

Every driver must handle registration fees in order to keep license plates valid and maintain legal permission to operate a vehicle on public roads. Officials in each state have unique methods for calculating amounts owed, which can depend on weight, age, value, or even fuel type.

A handful of states opt for a flat fee, while others use a more tailored approach. That variety has led to occasional confusion and comparisons about which locations might be more affordable.

A single question often pops up: What happens to the cash collected from owners each year? State agencies rely on registration fees to fund better roads, maintain robust safety programs, and handle paperwork and records. We’ll go more into detail about that in later sections.

Table of Contents

TogglePurpose of Registration Fees

1. Strengthening Infrastructure

Roads and bridges serve an essential role in society. Funding for repairs and enhancements often emerges from registration fees that funnel into transportation budgets.

Projects like fixing potholes, repaving highways, and building additional lanes all rely on consistent funds. Officials recognize that heavier vehicles produce more wear, so certain states require larger payments from those operators.

That approach aims to ensure those causing a greater effect on road surfaces pay proportionally.

2. Administrative Needs

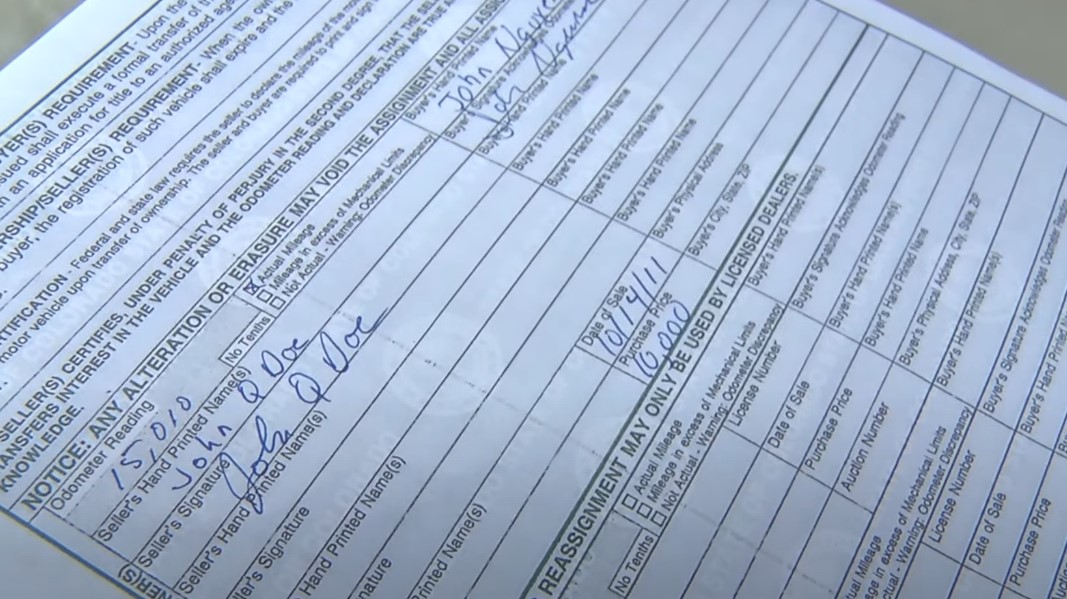

Registering a vehicle involves clerical tasks, database management, and systems that allow for transparent tracking of ownership. Registration fees keep departments of motor vehicles staffed and equipped with the technology needed for efficient record-keeping.

Personnel process documents like titles, manage driver information, and issue plates and stickers. That structure helps ensure accurate data, which can be critical for law enforcement, lenders, and anyone buying or selling a vehicle.

3. Public Safety

State patrols, emergency medical services, and road safety education rely on steady resources to support day-to-day operations. Officials often allocate a percentage of vehicle registration fees to cover those areas.

More money can mean better equipment, improved training, and broader public awareness campaigns. Having well-maintained roads also decreases accidents and response times, giving everyone a safer driving environment.

Factors That Affect Costs

1. Vehicle Weight

Heavier models often cost more to register. In locations like Hawaii, fees climb in proportion to weight. That higher amount stems from the fact that heavier vehicles contribute to greater wear on highways and byways.

Some states categorize ranges of weight, charging flat rates for each range. Others track precise vehicle weight and apply fees on a per-pound basis.

2. Age of the Vehicle

Newer vehicles sometimes have a higher registration cost. States that take age into account may charge larger amounts for late-model cars or trucks that have a higher market value. Owners of older vehicles can often pay a slightly lower rate.

Idaho stands as one state that includes age brackets in fee calculations, recognizing that a recently manufactured car might hold more value and, in turn, generate more revenue.

3. Type and Usage

Large commercial trucks, buses, and vehicles used for business purposes typically encounter different fee structures. Delaware provides an example: commercial vehicles surpassing 5,000 pounds pay higher rates, as per DMV Delaware.

Fleets used in delivery or transportation businesses put heavy strain on roads, so each state weighs usage in deciding how much to charge. Passenger car owners, on the other hand, often fall into a simpler pricing system.

4. Fuel Choice

Greater numbers of electric and hybrid vehicles have led to a drop in gasoline tax collections for many states. In response, certain states have approved additional fees for environmentally friendly models.

According to World Population Review, California imposes an annual fee on EVs, which varies based on the vehicle’s value. The fee starts at $100 for vehicles with a market value below $5,000 and increases incrementally, reaching up to $175 for vehicles valued at $60,000 or more.

As of 2024, 39 states have implemented additional registration fees for electric vehicles, with amounts ranging from $50 to $400, InsideEVs reports. Many of these states also impose fees on plug-in hybrid and hybrid-electric vehicles.

5. Market Value

A handful of states look at a vehicle’s value or Manufacturer’s Suggested Retail Price (MSRP) to figure out the amount owed. Pricier vehicles translate to higher registration fees.

Several states employ that valuation-based method, which can result in additional charges for luxury automobiles.

Some places, like Virginia, couple personal property taxes with registration processes, meaning owners of expensive cars face fairly large bills.

State-by-State Variations

Flat Fee States

Some places use a straightforward approach. Delaware offers an example by charging a $40 fee for vehicle registration across the board.

Many owners appreciate the simplicity of a consistent, predictable cost. That method avoids confusion about weight, age, and other factors.

Variable Fee States

Others opt for formulas blending multiple elements. Oregon calculates registration costs by examining model year, weight, and miles per gallon (MPG). Fees range from $122 to $152 for a fresh registration, as per Oregon.gov. Specifically, for passenger vehicles:

- 0-19 MPG: $252 for a four-year registration.

- 20-39 MPG: $272 for a four-year registration.

- 40 MPG or higher: $312 for a four-year registration

Plug-in hybrid owners pay an extra $110 annual fee on top of that. Additional variations can appear in states that modify rates for older vehicles, specialized plates, or local taxes.

UK’s License Plate System is Different Than in the US

In the UK, drivers generally buy vehicle registrations from the DVLA and then have plates printed by approved local suppliers such as jdmplates.co.uk.

That arrangement encourages a competitive market and offers more room for personalization, in contrast to many parts of the US, where government agencies often handle every step of the plate creation process.

Extra Fees and Taxes

Title Fees

Legally transferring ownership depends on acquiring a vehicle title. Certain states, like Georgia, charge roughly $18 for that proof of ownership. That document is crucial for sales and can protect buyers against fraud.

License Plate Fees

New plates can cost quite a bit in some regions. Illinois sets a plate fee at $151, although certain specialty plates carry additional charges. Owners can pay extra for designs promoting sports teams, charitable causes, or personalized messages.

Emissions Testing Fees

Areas concerned with air quality have emissions checks. Connecticut, for instance, collects a $40 Emissions Exemption fee. Those living in regions focused on clean air should set aside money for periodic tests or exemptions.

Local Surcharges

Counties sometimes tack on special levies or wheel taxes. Certain counties in Virginia impose a wheel tax, which varies from one county to another. That local add-on raises money for nearby infrastructure projects, often targeted at roads or transit.

Recent Developments

States have begun imposing targeted charges on electric and hybrid owners. A widely cited reason is to replace money lost to lower gas consumption.

Maryland, for example, boosted general registration fees by 60% or more starting July 1, 2024. Other states follow a similar path, aiming to cover a funding gap caused by more efficient, less polluting cars on the road.

Virginia uses a personal property tax approach in addition to standard fees, adding a layer of cost if an owner’s vehicle has a higher market value. The concept is that higher-value cars deliver more revenue potential, ensuring roads remain well-maintained for drivers statewide.

Breakdown of Registration Fees

1. State Highway Funds

A big chunk of each payment goes into state highway funds. Those funds cover:

- Repair and Maintenance: Patching potholes, resurfacing roads, and ensuring bridges stay structurally sound.

- Road Expansion: Widening busy stretches and constructing new lanes to ease traffic.

- Public Transit Enhancements: Improving bus and rail systems that operate under state management.

2. Administrative Costs

Processing, record-keeping, and staffing require steady support. That category includes:

- Registration Paperwork: Managing applications and renewals.

- Title Management: Issuing documents that confirm ownership.

- Plate Production: Creating physical license plates and stickers.

3. Public Safety Initiatives

Registration fees also bolster:

- Law Enforcement: Funding for state highway patrols and related agencies.

- Emergency Response: Ambulance services and equipment vital for accident responses.

- Safety Education: Campaigns to alert drivers about hazards, safe driving tips, or weather-based advisories.

4. Special Programs

Funds sometimes promote:

- Environmentally Focused Efforts: Incentives to switch to cleaner fuels or support infrastructure for electric charging.

- Priority Infrastructure: Routes in areas facing heavy traffic or economic hardship that might need more resources.

- Insurance Oversight: Prevention of fraud or assistance for victims of uninsured motorists.

Fee Structures by State

Many officials rely on two main setups:

Flat Fee Model

Massachusetts employs a single fee for most vehicle categories. That eliminates confusion about weight, age, or other elements.

Tiered Fee Model

California and Michigan examine vehicle weight or market value when calculating charges. Electric or hybrid owners often see an additional amount attached.

Electric and Hybrid Fees

An uptick in alternative-fuel vehicles spurred states to look for ways to offset lower gas tax income.

Colorado collects a $50 fee from hybrid owners and $100 from fully electric vehicles. Georgia’s approach involves a roughly $200 yearly charge for EVs.

Proponents argue that roads require the same upkeep, so owners of fuel-efficient rides should share in the cost.

Opponents sometimes feel that ongoing EV fees could discourage adoption of greener options. Each state balances that discussion in a unique way.

Reasons for Rising Rates

Several causes explain why charges have increased in recent years:

- Aging Infrastructure: Many highways date back decades and need constant attention. Costs of asphalt, steel, and labor have risen over time, compelling states to bump fees upward.

- Growth and Urbanization: More people are moving to metropolitan areas, placing heavier burdens on existing roads. Widening highways and adding new exits require ample resources.

- Declining Gas Tax: Higher efficiency engines and a move toward electric motors reduce revenue from traditional fuel taxes. An alternative channel is needed to sustain road projects.

- Inflation: Administrative expenses and maintenance costs rise in parallel with general inflation, pushing states to adjust their fee schedules.

Summary

Registration fees may not spark excitement for drivers, but those sums fulfill vital needs in every corner of the nation. Roads need repairs and expansions, departments of motor vehicles must stay operational, and public safety programs require consistent funding.

Variations in charges can feel vast, yet most states strive to strike a balance between stable revenue and fairness for all users.

A glance at annual fees around the country uncovers the array of approaches: flat rates, weight-based models, age-based structures, and additional charges for EVs and hybrids. Each method has roots in regional needs and aims to keep transit networks reliable. A bit of planning and research before buying or registering a vehicle can help owners prepare for costs.

Registration might feel like one more line item in the budget, yet the benefits seen in safer roads, clearer air, and streamlined record systems can make those fees worth paying in the long run.

References

- dmv.de.gov– Motor Vehicle Fees

- worldpopulationreview.com– Car Registration Fees by State 2024

- insideevs.com– These States Charge Extra Fees To Register EVs And PHEVs

- oregon.gov – Chapter M Fees

Related Posts:

- Worst Toyota 4Runner Years (And Why You Should Skip…

- Think Google Can Fix Your Car? Here’s Why You’re…

- What’s Affecting Car Prices in 2024 and Why 2025 May…

- Why Does My Car Smell Like Gas? Common Causes and Solutions

- Why Does My Car Squeak When Turning? Common Causes…

- Why the 1948 Ford Truck is Still an American Icon in 2025