Share Post:

A bargain is always tempting. Grabbing an affordable set of wheels can make daily commutes feel more manageable on the wallet. When a car has a rebuilt title, the price tag often seems like a dream come true.

Still, research and caution are vital before signing on the dotted line. A vehicle with a repaired history has unique qualities that can make or break long-term ownership satisfaction.

Today, I will share with you some of the pros, cons, and essential steps involved in choosing an automobile that has moved from salvage to rebuilt status.

Table of Contents

ToggleKey Highlights

- Rebuilt Cars = Savings: Rebuilt title cars cost 20-40% less but come with potential risks like hidden damage and insurance challenges.

- Inspection is Key: Always get a professional inspection and check repair history to ensure quality and safety.

- Know the Trade-Offs: Lower upfront costs may mean higher maintenance, insurance hurdles, and reduced resale value.

What Does a Rebuilt Title Mean?

A label known as a “rebuilt title” indicates a vehicle was once classified as salvage. That can happen after a serious accident, flood damage, or other incident leading to an insurance write-off.

Later, mechanics may have restored the automobile enough to meet certain roadworthiness standards. Once it undergoes relevant inspections, state authorities may reissue paperwork that flags it as rebuilt.

An equivalent term in some places is a “reconstructed title,” though laws vary between jurisdictions. Regardless of the terminology, the common thread is significant prior damage that required extensive repairs.

Overview of Different Vehicle Title Classifications

1. Clean Title

A ride with a clean title has no major damage in its record. Insurance companies haven’t labeled it as a total loss in the past. People generally expect fewer surprises with automobiles carrying a clean title.

2. Salvage Title

A vehicle with a salvage title has suffered substantial damage deemed too costly for standard repair. Insurance adjusters often declare it a total loss.

Cars in this category can be unsafe for routine use until repairs and inspections verify overall condition.

3. Rebuilt Title

Formerly salvaged, a rebuilt-titled vehicle has been refurbished to a point that it can legally be on the road again.

State inspectors sign off on the safety aspect, then issue relevant documentation that notes its newly repaired status.

Potential Advantages of Opting for a Rebuilt Title

Significant Cost Reduction

One of the most alluring benefits centers on the lower purchase price. Vehicles that have been rebuilt can be anywhere from 20% to 40% cheaper, making models that usually stretch the budget suddenly more attainable, as per CarInsurance.

An SUV or luxury sedan that felt out of reach might become viable thanks to that discount.

Less Depreciation Shock

Automobiles lose value over time, but a rebuilt title vehicle has already taken a big hit in resale worth. While no car is entirely immune to depreciation, the curve for a rebuilt ride might be less steep.

Potentially High-Quality Repairs

A major accident or flood scenario doesn’t always mean the vehicle is permanently damaged beyond hope. Repair shops that specialize in collision work may bring it back to life using expert techniques and premium parts.

In select cases, a rebuilt model drives almost like one fresh off the lot. Thorough checks are advisable, though, to confirm quality standards were met.

Downsides of Purchasing a Car with a Rebuilt Title

Possibility of Hidden Damage

Serious collisions and floods can hide traces of damage that stay dormant. For example, water exposure might trigger electrical troubles months after purchase.

Wires can corrode, sensors might fail, and other glitches may appear unexpectedly. Even if the car runs well initially, underlying flaws can pop up over time.

Difficulty with Insurance

Companies offering comprehensive or collision coverage may be reluctant to insure a rebuilt vehicle. Some providers only offer liability policies, leaving owners unprotected against theft or damage.

Even if an insurer approves broader coverage, premiums could be higher or come with specific limitations.

Challenges with Financing

Traditional lenders tend to view rebuilt cars as higher-risk assets. Loan approval might be tougher to secure, requiring alternative financing or a cash transaction.

Reduced Resale Opportunities

In the event you want to part ways with the automobile, finding a buyer willing to pay a fair price can be tough.

Dealerships may lowball trade-in offers, and private parties might be wary upon hearing the word “rebuilt.” That can limit your exit strategy and impact overall return on investment.

Safety Worries

Subpar repair jobs can jeopardize structural integrity, making a subsequent collision more hazardous. Thorough inspections remain paramount to confirm everything is in order.

An improperly welded frame or cheap replacement parts raise red flags for anyone concerned about secure transportation.

Elements to Investigate Before Buying

1. Detailed Vehicle History Report

Learning about the car’s past through a provider like Carfax or AutoCheck can help reveal accidents, flood issues, ownership changes, and other pivotal details.

Scrutinize that report carefully. If something seems amiss, it might be a signal to pause your plans.

2. Professional Inspection

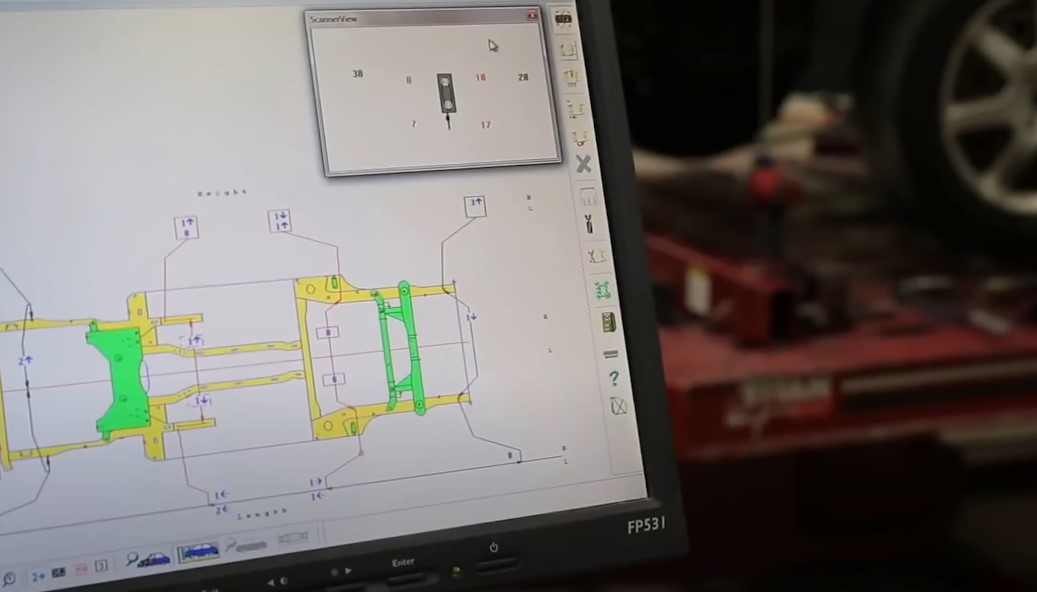

Bring a certified mechanic or trusted automotive expert into the picture. A thorough inspection can confirm whether repairs align with professional standards.

Ask them to check the engine, transmission, electrical system, structural welds, and everything in between. Subtle warning signs might be easy to miss for a casual observer.

3. Repair Documentation

Receipts and service records can illustrate repair quality and whether skilled professionals completed the work. Look for the reputation of the body shop or mechanic.

Ask about the brand of parts used, along with details about alignment, frame checks, and paint matching.

4. Check Insurance Options Ahead of Time

Speak with multiple insurance agents and companies. Clarify coverage limitations and gather quotes for liability-only policies versus comprehensive.

Some providers might be open to a broader policy if the repairs were top-notch, while others refuse to touch a car with a complicated background.

5. Be Aware of Local Regulations

State laws concerning rebuilt titles differ. Certain areas mandate specific inspections, forms, or disclosures.

Local Department of Motor Vehicles websites usually have guidelines on registration procedures. Careful research ensures a smoother process when registering and insuring.

Steps to Take if Committed to Buying a Rebuilt Vehicle

Negotiate the Purchase Price

- Bring up any concerns or potential pitfalls.

- Use a detailed history report as a bargaining tool.

- Factor in the diminished resale value and possibly higher insurance costs.

Keep Paperwork Organized

- Save digital or physical copies of repair receipts, inspection documents, and the title itself.

- Store mechanic contact information for questions or future repairs.

- Document anything that might be useful if reselling the vehicle later.

Plan a Maintenance Fund

- Set aside money for repairs beyond routine oil changes and tire rotations.

- Flood damage, past collisions, or replacement parts can lead to ongoing upkeep.

- A bit of financial readiness reduces stress in case an unexpected issue arises.

Other Options to Think About

@lindsberg4real What is the difference between a certified pre owned car and a used car? Watch this video to find out! . . . #carsoftiktok #cardealershiplife #cartok #carsalesman #carshopping #autosales #cars #detroit #cardealership #cartiktok #dealership #carsaleslife #carbuy #carbuyinghelp #carfinancing ♬ original sound – Lindsberg Pettway

Certified Pre-Owned (CPO)

Manufacturers offer programs where a used car undergoes extensive testing, typically with a warranty included. Although the upfront cost is higher than a rebuilt model, buyers gain peace of mind.

Inspections for a CPO model are often thorough, with an assurance that major systems meet the automaker’s benchmarks.

Private Sales with Clean Titles

Sometimes an individual seller offers a fair deal on a clean-titled vehicle. There could be room to negotiate an even better price, especially if that person wants to sell fast.

A bit of patience plus thorough personal research can unearth a gem that won’t raise doubts with insurers or lenders down the road.

Summary

A ride with a rebuilt title can deliver an appealing combination of lower cost and access to models that might be outside an average budget. It carries risks that require plenty of homework, expert input, and careful thought.

A balanced view of cost savings and potential pitfalls helps buyers pick the right route. Those who prize long-term financial stability and fewer hassles might opt for a clean title.

Others could embrace the risk for a well-restored automobile at a bargain price. Spend time gathering facts, seek reputable professionals for advice, and thoroughly explore the vehicle’s condition.

That approach often leads to the most rewarding outcome—knowing a major purchase was made with confidence and clarity.

Related Posts:

- Hatchback vs. Sedan - Pros, Cons, and Which One to…

- The Pros and Cons of 32 Amp vs. 40/50 Amp EV Chargers

- Is Synthetic Oil Really Worth It? Pros and Cons Compared

- Should You Really Buy a Car Online? Pros & Cons Explained

- 15 Best Electric Cars Under $50,000 in 2025 -…

- How to Transfer a Car Title to a Family Member