Share Post:

Many people spend more on gas than they’d like. According to J.D. Power, the national average hovers around 204 dollars per month—or about 2,448 dollars per year—yet plenty of drivers end up forking over a lot more, thanks to volatile prices and varied driving habits.

That’s the quick snapshot. Now let’s break down the main factors, the regional nuances, and a few tactics for lowering that painful bill at the pump.

Table of Contents

ToggleMonthly and Annual Averages

Experts often cite about 204 dollars each month as the standard outlay for gasoline in the United States. Over the span of a year, that figure lands around 2,448 dollars.

Some might expect that sum to be consistent across the nation, but there’s a broad range of numbers lurking beneath the surface.

For instance, past data provided by the U.S. Energy Information shows individual states logging gasoline expenses as low as 400 dollars and as high as 1,400 dollars per capita annually.

It’s certainly not a one-size-fits-all scenario. Gas spending also takes up around 2.57% of Americans’ monthly income on average. In more affluent households, that share seems like a drop in the bucket.

In contrast, families on tighter budgets may find fuel eating up a larger slice of their monthly resources. Moreover, any sudden leap in gas prices can disrupt financial stability for lower-income groups.

Influences on Fuel Costs

Life would be simpler if everyone paid the same at the pump. Unfortunately, global oil markets, local regulations, and personal circumstances all play a part in shaping the final tally.

That interplay can make average monthly costs fluctuate more than anyone would like.

1. Fuel Prices

Economists track global oil prices incessantly. Conflicts in major oil-producing regions or shifts in supply affect the cost of a barrel, which then ripples through local gas stations.

Seasonal demand also makes a difference. Summer road trips, for example, often spur price increases. At one point in 2022, the national average price per gallon soared above four dollars.

If a person was routinely paying around three dollars per gallon, that one-dollar jump ballooned monthly costs by a significant margin.

2. Driving Habits

A remote worker who logs only a few miles a week might marvel at those who fill their tank multiple times in seven days.

Commuters traveling long distances, people with side gigs involving constant driving, or fans of frequent weekend getaways all rack up sizable bills.

Aggressive driving—rapid acceleration and hard braking—can make the situation worse, burning more fuel than necessary.

3. Vehicle Fuel Efficiency

Think of a hybrid car that breezes past gas stations versus a behemoth truck that guzzles gallon after gallon. Vehicle type plays a huge role in final bills.

Anyone who owns a fuel-efficient ride could be looking at half the cost per mile compared to drivers of older or less efficient models. Regular upkeep helps even more.

A neglected engine, low tire pressure, or old spark plugs drain your wallet as well as your gas tank.

4. Location

Some states, such as California, impose higher environmental taxes on fuel, driving up local prices. Other parts of the country, including Texas and Louisiana, benefit from close proximity to refineries, often seeing cheaper rates.

Within metropolitan areas, competition can influence costs too, leading certain gas stations to undercut each other’s prices.

California imposes higher taxes on gasoline, contributing to elevated local prices. As of January 1, 2024, California’s gas tax stands at 68.1 cents per gallon, the highest in the nation, as per the Tax Foundation.

5. Income Levels and Lifestyle Choices

Wealthy individuals often don’t flinch at a few extra dollars at the pump, but low-income families can find even minor price spikes alarming.

Urban residents with ample public transportation can skip driving altogether, trimming monthly gas spending dramatically.

Meanwhile, those living in rural zones may have to cover many miles to get to work or school, so they often pay a premium in fuel.

Income-Based Breakdown of Monthly Gas Expenditure

A person’s income bracket can shape gas spending patterns more than some realize. It’s not just the total earnings—vehicle ownership, job location, and public transit infrastructure all interact to form the bigger picture.

Low-Income Households

Many end up spending 10% or more of their monthly income on gas. A lack of fuel-efficient cars and scarce public transportation options compound the problem.

Carpooling becomes a lifeline in some communities, but that’s not always an option.

The American Council for an Energy-Efficient Economy (ACEEE) found that low-income households had an average gasoline burden of 13.8%, compared to just 4.1% for higher-income households.

Middle-Income Households

Roughly 3–5% of income tends to go toward gas. People in this category might drive moderately efficient vehicles, and they often live in areas that allow shorter commutes or partial reliance on buses, trains, or rideshare services.

High-Income Households

Gas can dip to around 1–2% of monthly earnings. Even with expensive, high-performance vehicles, the burden is cushioned by a larger paycheck.

Although some individuals in this group drive gas guzzlers, others switch to electric cars or hybrids for convenience, environmental concerns, or simple preference.

Urban vs. Rural

City dwellers have the luxury of public transportation, denser communities, and ride-sharing services galore. Many avoid owning a personal car.

That approach can slash gas costs to virtually nothing—except for occasional rentals or paid rides. Rural residents rarely get that luxury.

Long drives to the nearest grocery store, medical facility, or workplace become commonplace. Public buses and trains may be nonexistent.

Older vehicles also remain prevalent in these areas, often due to lower upfront costs. Consequently, gas expenditures can be disproportionately high, stretching budgets and curbing savings.

Shifts Over Time

Gas expenditures have not remained static over the past few decades. Technological breakthroughs, global events, and unpredictable economic cycles keep the trend in motion.

2000–2010

Oil prices climbed steadily in the early 2000s, reaching a climax around 2008 when a gallon of gas topped four dollars in many regions.

Drivers started feeling the financial pinch, triggering more serious conversations about fuel economy, carpooling, and alternative energies.

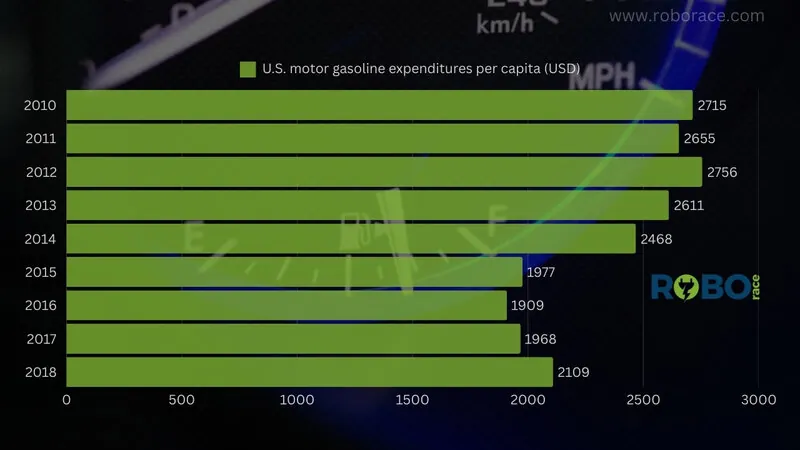

2010–2020

Improved fuel efficiency took center stage. Gas prices plateaued somewhat, hovering at more manageable levels, though occasional spikes still appeared.

Many jumped on the hybrid and electric car bandwagon, reducing reliance on traditional gasoline-powered engines. Rideshare services like Uber and Lyft also emerged, changing how some people approached car ownership.

2020–2022

The global pandemic triggered a dramatic drop in demand, which caused gas prices to tumble for a stretch. Not long after, supply issues emerged alongside economic recovery, fueling a sudden rebound in costs.

Some areas hit record highs. Hybrid and electric vehicle sales surged again, driven partly by frustration over elevated pump prices.

Global Perspectives

Not everyone on the planet enjoys cheap gasoline. Americans pay relatively modest taxes on fuel, so the price at the pump tends to remain lower than in much of Europe.

According to Carscoops, in the United States, the combined federal and state taxes average approximately $0.49 per gallon for gasoline and $0.57 per gallon for diesel.

In contrast, European countries impose significantly higher taxes on fuel.

For instance, the Netherlands levies a tax of $4.96 per gallon on gasoline and $3.44 per gallon on diesel, while Italy imposes taxes of $4.43 per gallon on gasoline and $3.86 per gallon on diesel.

The Bigger Picture for Household Budgets

Many Americans don’t mind a small percentage of income going toward gas. Cars provide flexibility, convenience, and independence—qualities deeply ingrained in the nation’s culture.

The problem shows up when prices balloon, rattling monthly budgets that already juggle housing, healthcare, and education costs.

Officials sometimes debate interventions like gas tax holidays or strategic oil reserve releases, although the real impact can be short-lived. Meanwhile, technological progress continues at a rapid clip.

Greater adoption of electric vehicles, more efficient gas engines, and public transportation improvements could eventually reduce reliance on traditional fuel. Still, those changes require time, infrastructure investment, and willingness from drivers to embrace new approaches.

Some households opt to move closer to work or relocate to areas with better transit connections. Others switch to remote jobs whenever possible.

A few embrace rideshare services full-time, relying on personal cars only for special occasions.

Tactics for Reducing Fuel Bills

Stepping away from a traditional vehicle altogether is an option for a select few, but most people still need to drive. Several methods can trim monthly gas spending:

Gentle Driving Style

Floor the accelerator at every green light, and that needle on the gas gauge moves faster. A relaxed approach—steady speeds, easy starts and stops—keeps fuel consumption in check.

Carpooling and Public Transit

Splitting the drive with friends or coworkers can cut personal fuel expenses significantly. In many urban areas, subways and buses offer cost-efficient alternatives, albeit with some limitations around routes and schedules.

Opting for More Efficient Vehicle

A brand-new electric car might feel intimidating price-wise, but small hybrid or eco-friendly models often offer substantial savings over time.

Even making sure to keep an older car well-maintained can yield a noticeable boost in miles per gallon.

Routine Maintenance

Simple tasks like proper tire inflation, regular oil changes, and timely engine tune-ups can improve efficiency. Over time, even minor improvements add up to real money.

Better Route Planning

Unnecessary errands and mindless zig-zagging around town burn extra gallons. Bundling chores into one trip and making use of apps or in-car navigation to pick the shortest route can spare a chunk of cash.

Summary

Gas spending in the United States averages around 204 dollars per month, or nearly 2,448 dollars a year, for a fairly typical driver. Variations in fuel prices, vehicle efficiency, and commuting patterns can spike or shrink that figure.

It’s wise to keep an eye on changing prices and tweak driving habits accordingly. By opting for more efficient cars, carpooling, or embracing public transit, many people can ease the sting at the pump and gain a bit more control over their finances.

Related Posts:

- How Much Does a Police Car Cost - A Breakdown of…

- Why Does My Car Smell Like Gas? Common Causes and Solutions

- US Tariffs On Chinese Cars: How Much More You Will…

- 12 Reasons Why Gas Cars Are Better Than Electric in 2025

- What is the Open Charge Point Protocol (OCPP) and…

- What is EV Charging Load Management and How Does It Work?